PERSONAL LOANS

Car loans: financing that gets you on the road

Ready to purchase a new car? You might be wondering how to pay for it. Find out here if a car loan is the right solution for you.

iStockphoto/shapecharge

1. What is a car loan?

A car loan is a loan that you can take out to finance the purchase of a vehicle. For most lenders, car loans are actually the same as personal loans.

This means that the loan is not tied to the intended use. You can also use it for something other than financing a vehicle. The term "car loan" is used in order to highlight the differences and advantages compared to a car lease.

2. The advantages of a car loan

The car is not linked to any financing agreement.

No calculation of residual value or pre-emption right.

Debt interest can be deducted from your taxes.

You can repay a loan early at any time.

There are no additional costs when terminating the contract.

Car purchase: Switzerland

Financing the purchase of a car is the most common reason for taking out a loan. More than one fifth of Swiss households have at least one loan for buying a car. (Source: Swiss Federal Statistical Office, published February 2020, not available in English).

3. When does it make sense to take out a loan for buying a car?

When buying a car, you have the option of paying with your available means (e.g. in cash, via bank transfer, etc.), entering into a leasing agreement or taking out a car loan. Paying in cash is definitely the cheapest option, but the funds aren't always available.

If your budget is tight, it often makes more sense to take out a loan to buy a used car instead of leasing a new car. This means that most cars bought on credit are vehicles for everyday use, not luxury purchases.

Reasons for taking out a car loan:

You can't wait to make the purchase

Your family is about to grow

Your current car broke down

You don't want to dip into your savings

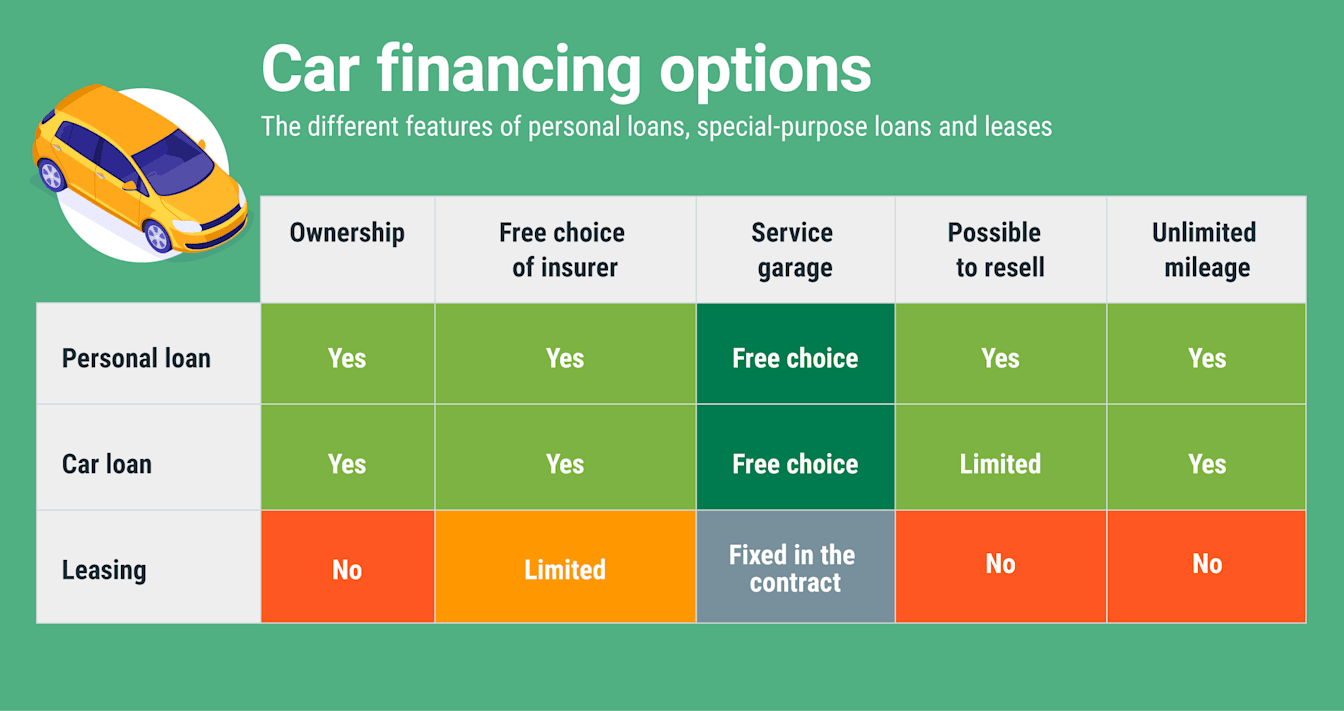

4. Comparison: car loans, leases and loans for a specific purpose

The most common vehicle financing options are personal loans, specific car loans and leasing.

More information:

When does it make sense to choose a car loan vs. leasing?

Loans for car purchase in the loan comparison tool

Calculate the cost of your car loan using our credit calculator

5. Specific car loans: Cembra and BCGE

Lenders usually call it a car loan for marketing purposes.

In Switzerland there are currently only a few loan options specifically for purchasing a vehicle. Unlike standard personal loans, they are strictly car loans that you must use to buy a car.

You can only take out the loan from a specialist dealer. The loan is not directly transferred to the borrower but to a specialist dealer, usually a garage or car dealership.

Cembra Financing Plus (for used cars)

BCGE car loan (offered by Banque Cantonale de Genève)

The main feature of a dedicated car loan is that the car acts as a seizable asset in case of non-payment – the same as with leasing plans. This has an impact on how the lender assesses the risk of the loan and the eligibility criteria for the borrower.

Dedicated car loans are tied to the underlying seizable asset (in this case, the car) and come with additional requirements. In the case of Cembra, these requirements are for example as follows:

Code 178 "Change of keeper prohibited" applies (as for leasing). You can't simply sell the car.

A retention of title will be registered for amounts of CHF 25,000 and above.

At 7.95% or 10.95%, the interest rates for Cembra car loans are no cheaper than Cembra personal loans.

6. Higher chances of success for your loan

When taking out a car loan, the same conditions apply as with a normal personal loan.

You will need to undergo an individual credit check to find out whether you'll be approved for a loan and under what conditions. When it comes to interest rates, the following applies: the lower the interest rate, the stricter the criteria for the borrower. Around half of all direct loan applications to banks are rejected.

Intermediaries can increase your chances of getting the amount you want: the loan experts at Credaris will place your enquiry with a suitable lender.

7. FAQ – frequently asked questions about car loans

Yes. In Switzerland, you can refinance or pay back a loan in full at any time, thereby terminating the contract.

The interest rate you receive depends on your credit score. You first need to submit a loan application in order to find out whether you'll be approved and what interest rate you'll receive. You can check approximately how much you can borrow by using our affordability calculator.

Interest rates range from 4.4% to 10.95%. The interest rate you receive depends on your credit score and the lender's risk assessment. Around half of all loan applications are rejected. You can submit a free loan enquiry to get an opinion on your options and possible interest rate.

In order to submit a personal loan application, you will need to provide your salary statement(s) and a notarized copy of your identity card or passport. Non-Swiss residents will need to provide a copy of their settlement or residence permit or their passport. Lenders will often request a copy of your tenancy agreement as well. Whether other documents are needed at a later stage of the application process depends on your personal situation and the requirements of the lender. You can find out more under Taking out a loan.

The eligibility requirements for a car loan are the same as for a normal personal loan. The basic criteria include your credit capacity and creditworthiness, age, occupation, etc. Furthermore, every lender uses internal criteria that are not published for security reasons. You can find out more about eligibility criteria here.

This article was first published on 10.11.2017